19-284 Prop 56 Rates for 2019-2019

Date: 04/12/19

Approved rates and new codes added for specific physician services performed from July 1, 2018, through June 30, 2019

The Department of Health Care Services (DHCS) has approved new Proposition 56 (Prop 56) supplemental payment rates. The new rates apply to the state fiscal year (FY) July 1, 2018, through June 30, 2019.

Supplemental payments are not part of the base provider compensation under the Provider Participation Agreement (PPA). They are also separate from contracting rates with primary care physicians (PCPs) or Community Care Independent Practice Association (CCIPA).

2018–2019 SUPPLEMENTAL RATES

The table below lists the FY 2017–2018 and 2018–2019 supplemental rates for existing CPT codes. Some rates did not change.

CPT code | FY 2017–2018 rate | FY 2018–2019 rate |

| CPT code | FY 2017–2018 rate | FY 2018–2019 rate |

90791 | $35 | $35 |

| 99205 | $50 | $107 |

90792 | $35 | $35 |

| 99211 | $10 | $10 |

90863 | $5 | $5 |

| 99212 | $15 | $23 |

99201 | $10 | $18 |

| 99213 | $15 | $44 |

99202 | $15 | $35 |

| 99214 | $25 | $62 |

99203 | $25 | $43 |

| 99215 | $25 | $76 |

99204 | $25 | $83 |

|

| ||

The table below lists the CPT codes that are new for FY 2018–2019 with their supplemental rates.

CPT code | FY 2018–2019 rate |

| CPT code | FY 2018–2019 rate |

99381 | $77 |

| 99391 | $75 |

99382 | $80 |

| 99392 | $79 |

99383 | $77 |

| 99393 | $72 |

99384 | $83 |

| 99394 | $72 |

99385 | $30 |

| 99395 | $27 |

HOW THE SUPPLEMENTAL PAYMENT WORKS

Claims or encounters with a code listed in one of the tables on page 1 will be paid the corresponding FY 2018–2019 rate.

If the date of service is… | We will process supplemental payments for… | And payments are made… |

July 1, 2018–September 30, 2018 |

|

|

October 1, 2018–November 30, 2018 | FY 2018–2019 new codes and rates | Starting in March 2019 |

December 1, 2018–June 30, 2019 | FY 2018–2019 new codes and rates | Starting in March 2019 and as DHCS releases funds |

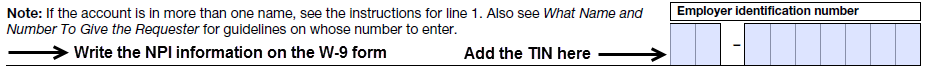

ADD THE PHYSICIAN NPI WITH TIN TO W-9 FORM

If a physician has not received any Prop 56 payments, the physician needs to send in an individual W-9 form by email or fax (see Where to send your W-9 form below). After receiving the individual physician’s W-9 form, payments will take about five weeks to process and send.

The form must include the physician’s:

· National Provider Identifier (NPI) – If two NPI numbers are used (individual and group), include both NPI numbers where space is available

· Individual taxpayer identification number (TIN)

Example:

WHERE TO SEND YOUR W-9 FORM

A W-9 form is included with this communication. You can also download it from the Internal Revenue Service (IRS) website at www.irs.gov/pub/irs-pdf/fw9.pdf with complete instructions.

Send in a current or updated W-9 by email or fax.

HNCA_W9_Submissions@CENTENE.COM (Clearly add the words “Prop 56 W9” in the subject line.) | |

FAX | 1-833-794-0423 (Include a cover sheet and clearly add the words “Prop 56 W9” and “PROTECTED HEALTH INFORMATION.”) |

ADDITIONAL INFORMATION

In addition to this notice, our call center representatives will contact providers who still need to send a W-9 form.

If you have questions about the status of your W-9, requesting a Remittance Advice (RA) or questions about Prop 56 payments, contact CHWP’s Provider Services Center at 1-877-658-0305.