19-122 Submit W-9 Form to Receive Prop 56 Supplemental Payments

Date: 04/17/19

Email or fax a current W-9 and add “Prop 56 W9” in the subject line or on the cover sheet

California Health & Wellness Plan (CHWP) has received funds for Proposition 56 (Prop 56) supplemental payments; however, issuing payments on eligible services requires a W-9 form from all Medi-Cal physicians. After receiving the W-9 form, payments take about five weeks to process and send to providers.

The W-9 form must include the individual physician’s:

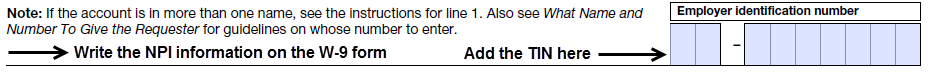

- National Provider Identifier (NPI) – If two NPI numbers are used (individual and group), include both NPI numbers where space is available or submit on a separate page with the W-9 form.

- Individual taxpayer identification number (TIN).

SUBMITTING A W-9 FORM

A W-9 form is included with this communication. It can also be downloaded from the Internal Revenue Service (IRS) website at www.irs.gov/pub/irs-pdf/fw9.pdf with complete instructions.

Send a current or updated W-9 using the new email or fax number below:

HNCA_W9_Submissions@CENTENE.COM (Clearly add the words “Prop 56 W9” in the subject line.) | |

FAX | 1-833-794-0423 (Include a cover sheet and clearly add the words “Prop 56 W9” and “PROTECTED HEALTH INFORMATION.”) |

ADDITIONAL INFORMATION

In addition to this notice, our call center representatives will contact providers who still need to submit a W-9 form.

If you have questions about the status of your W-9, requesting a Remittance Advice (RA) or questions about Prop 56 payments, contact CHWP’s Provider Services Center at 1-877-658-0305.